Are you a homeowner in Fresno County, California looking to sell your property but worried about its liens? Don’t panic; you are not alone in needing to sell a house with a lien. Liens can be a notable barrier when you need to sell a house fast, as they place a lien on the property and must be cleared before a sale can go through. In this post, we’ll delve into the realm of liens, explaining what they are, how they can prevent you from selling your home, and most crucially, how you can resolve them. We’ll cover everything from the types of liens that exist to six actionable steps that you can take to sell a house with a lien on it. Whether you’re mulling over paying off the lien, arranging a payment schedule, or collaborating with a real estate investor who can buy houses even with liens, we’ve got you covered. Read on to find out more about how Click Cash Home Buyers can help you sell your house with liens quickly and easily!

Can you sell a house with a lien on it?

Selling a house with a lien is feasible, but the process can be complex. Before you can turn the outstanding debt to the lien holder must be settled to sell a house with a lien.

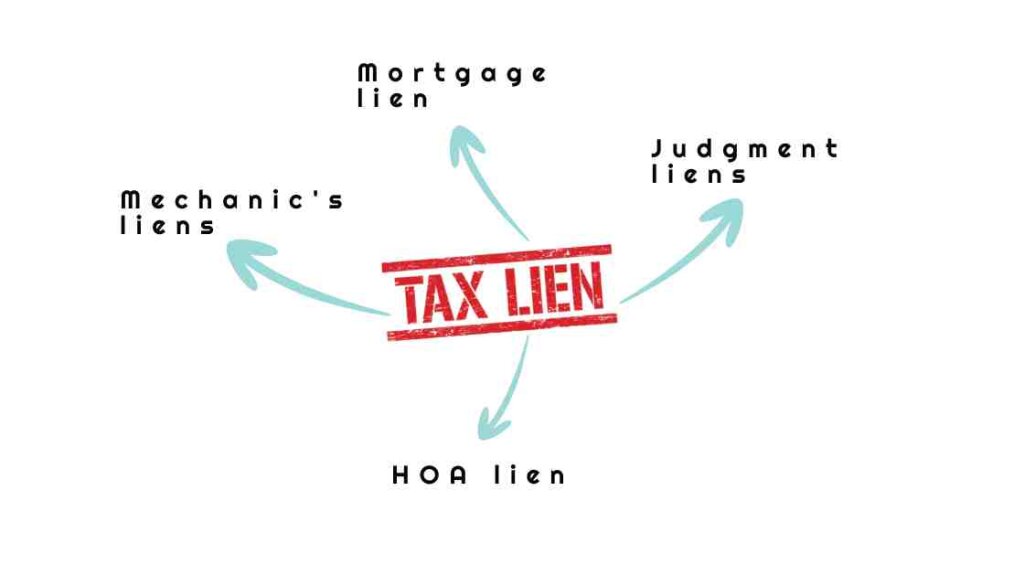

Types of property liens

Property liens, which can potentially lead to foreclosure, appear in many forms like mortgage and tax liens, each with unique traits. They encompass mortgage, tax, judgment, child support, HOA, and mechanic’s liens, covering various aspects of homeownership and financial duty, which could even put you in a situation where you fail to pay and end up with a foreclosure. Recognizing these types is vital when working through the complexities of selling a property with a lien, guaranteeing a smooth transaction, and conformity with county recorder legal requirements.

Mortgage lien

A mortgage lien serves to secure the mortgage lender’s interest in the property until the mortgage is fully paid off. This legal claim grants the lender the right to take possession of the property if the borrower defaults on the loan. Until the mortgage is fulfilled, the mortgage lien holder keeps a legal claim on the property and can exercise the legal entitlement to foreclose on it should the borrower fail to pay. This emphasizes the significance of grasping the repercussions of a mortgage lien when you need to sell your house.

Tax lien

When property taxes or income tax stay unpaid, the county recorder could place a tax lien on the property, disrupting its sale. A tax lien represents a legal claim by the government for unpaid property taxes or income taxes, impacting the property’s sale. Due to the failure to pay taxes, this legal claim can bind to the property, potentially acting as a roadblock to the release of the lien is essential to clear the title and ensure that the home sale proceeds can cover the remaining debt and closing costs. Understanding tax liens is crucial when dealing with a home sale with lien issues.

Judgment lien

A judgment lien is a court-ordered claim against the property to fulfill a debt owed by the owner. It grants the creditor the legal right to the proceeds of the property sale to satisfy the debt. When enforced, the creditor has a legal claim to the property to recover the owed debt. This legal action allows the creditor to place a claim on the property to collect the debt owed by the owner, ensuring the release of the lien upon debt satisfaction.

Child support and alimony liens

Legal claims for unpaid child support and alimony create liens against the property, impacting the sale process. When property owners owe unpaid child support or alimony, ensuring payment may involve placing liens on the property. Unpaid child support and alimony can lead to the imposition of liens, enabling the enforcement of legal claims against the property. These liens create a significant impact, affecting the property’s sale and the recovery of unpaid support.

HOA lien

An HOA lien, resulting from unpaid dues to the homeowners’ association, can significantly impact the sale of a property. It represents a legal claim enabling the association to assert control over the proceeds of the property sale to cover the outstanding dues. Non-payment of HOA dues can lead to the imposition of a lien on the property, influencing the overall sale process. This legal encumbrance can complicate the sale and must be addressed to ensure a smooth transaction.

Mechanics lien

When contractors or subcontractors are not compensated for property work, a mechanic’s lien can be placed to ensure payment. This legal claim on the property is essential for securing compensation. Failure to pay contractors or subcontractors for their work can lead to the imposition of a mechanic’s lien, giving them a legal stake in the property. It’s crucial to understand the implications of a mechanic’s lien, as it significantly influences the sale process.

6 steps to selling a house with a lien

Determine if there’s a lien against your property through a title search. Seek advice from a real estate attorney to comprehend the legal implications of the lien. Negotiate with the lien holder to ascertain the payoff amount and payment plan, if needed. Proceed with the sale process, ensuring the lien holder is paid from the home sale proceeds. Acquire a lien release to release the legal claim on the property after paying off the lien. Finalize the sale with the support of a title company to ensure a smooth transfer of ownership.

1. Determine if there’s a lien against your property

Start by checking public records for any property liens. Once identified, determine the type and amount of the lien. Seek guidance from a real estate lawyer to understand your options. Consider negotiating with the lien holder to reduce or remove the lien, and be transparent with potential buyers about its presence and the steps taken to address it. This will ensure a smooth home sale process and help you navigate the complexities of dealing with a property tax lien or any other type of lien.

2. Determine the type of lien you’re facing

Before selling your house, it’s crucial to comprehend the implications of a lien on the property and classify the specific type of lien. Whether it’s a tax lien or a mechanic’s lien, seeking legal counsel is advisable to address the situation effectively. Collaborating with an attorney can aid in resolving the lien before proceeding with the sale. Moreover, initiating negotiations with the lien holder to minimize the outstanding amount is an option worth considering. It’s also imperative to transparently disclose the existence of the lien to potential buyers and work collectively to find a viable resolution.

3. Validate the lien before disputing it or reaching a settlement

Before disputing a lien or reaching a settlement, it’s crucial to grasp how a lien impacts property sales. Seek legal counsel from a real estate attorney or title company to verify the legitimacy of the lien. Validate it before engaging in disputes or settlements. Negotiating with the lien holder for a settlement or payment plan is advisable. Arrange all essential paperwork to facilitate the property sale. This due diligence is vital to ensure a seamless transaction and compliance with NLP terms.

4. Pay the lien and clear the title

Before proceeding with the sale of your property, it is essential to comprehend the impact of a lien on the transaction. Identifying the lien type and amount allows for negotiation with the lien holder to potentially reduce the debt. In cases where the lien surpasses the property’s value, exploring a short sale becomes crucial. Clearing the title by paying off the lien is paramount to evade legal complications during the sale.

5. Consider your options

When dealing with a lien on your property, it’s essential to understand its impact on the home sale. Seeking legal advice can help address any existing liens and determine the amount owed. Negotiating with the lienholder is crucial; consider paying off the lien before selling the house or disclosing it to potential buyers. Adjusting the asking price accordingly ensures transparency. By considering these options, you can navigate through the complexities of selling a house with a lien and make informed decisions to proceed with the sale.

6. Consult with a Southern California real estate investor

When dealing with a lien on your property, consulting with a Southern California real estate investor can be a valuable option. Prioritizing the payment of the lien, getting legal advice, and being transparent with potential buyers are crucial steps. Working with an experienced real estate agent familiar with liens can also make the process smoother. Additionally, exploring the possibility of selling your property as-is, with the lien included, to a Southern California real estate investor can offer a practical solution. Disclosing the lien and any associated restrictions upfront is essential for a transparent transaction.

How to sell a house with a lien?

Consider seeking guidance from a real estate attorney experienced in liens. Conduct a thorough title search to confirm all outstanding liens. Understand the process of obtaining a lien release. Evaluate the impact of the lien on the property’s value. Explore options for selling with the lien in place.

Sell to a real estate developer

Consider selling your property to a real estate developer, as they often possess the necessary resources to manage liens effectively. Developers are typically attracted to the potential value of a property and may be inclined to expedite the resolution of any liens associated with it. Moreover, their experience in addressing property liens could prove beneficial in streamlining the process. Assess the advantages of engaging with a real estate developer and leveraging their expertise in handling liens to facilitate the sale.

Pay off the lien before listing

Paying the lien before the listing can streamline the sale process, enhance property marketability, and attract more potential buyers. Addressing the lien upfront minimizes legal issues during the sale and considers the financial implications. Clearing the lien can lead to a smoother closing process, where the home sale proceeds are used to pay off the remaining debt and any remaining funds can be utilized by the seller. Working with an experienced real estate agent can help navigate the process seamlessly.

Pay off the lien with your sale proceeds

Simplifying the process by using the sale proceeds to clear the lien can streamline the sale. It’s essential to calculate the lien payoff amount from the anticipated sale proceeds and assess its impact on the remaining sale proceeds. Understanding the legal requirements for using sale proceeds to clear the lien is crucial. Evaluating the feasibility of using sale proceeds to address the lien ensures a smoother transaction. Consider consulting an experienced real estate agent for guidance in this process. Assessing your options will help determine the best way to proceed.

Negotiate a payment plan

When addressing a property liens situation, negotiating a manageable payment plan with the lien holder is crucial. Consider the impact of the payment plan on the property sale timeline and assess its legal implications. Evaluate the feasibility of fulfilling the payment plan during the sale process while addressing the concerns of the lien holder to secure a favorable agreement. Communication and transparency are key in this negotiation process to ensure a smooth transaction.

Dispute the lien in question

When disputing the lien, it’s crucial to identify any discrepancies or errors linked to the claim. Gathering evidence to support the dispute is essential and consulting a real estate attorney can provide insight into the legal process. It’s important to consider the potential impact of a successful dispute on the property sale and evaluate the risks and benefits associated with initiating a dispute with the lien holder. Seeking professional advice and weighing the outcomes will help make an informed decision.

Work with a local real estate investor

When selling a house with a lien, consider collaborating with a local real estate investor. Local investors possess experience in dealing with properties affected by liens and can offer creative solutions to address the lien. Working with an investor may expedite the resolution of the lien, and it’s crucial to evaluate the advantages of this collaboration. Additionally, it’s important to understand the potential impact of the property lien on the investor’s offer, ensuring a smooth and beneficial transaction for all parties involved.

Can I sell my house with a lien on it to you?

Selling your house with a lien to a real estate investor can provide a swift and practical solution. It expedites the process and simplifies the sale, offering a viable resolution for homeowners facing liens on their properties.

Key takeaways on selling a house with liens

Understanding the critical aspects of offloading a property with liens is crucial for a successful home sale. Summarizing the important points provides valuable insights into navigating the complexities of liens and property sales. Emphasizing these key takeaways offers clarity on the process, making it easier for property owners to comprehend and navigate through the sale, including handling back taxes, release of liens, and closing costs. This understanding is essential for both individuals and experienced real estate agents dealing with properties burdened by liens.

FAQs

Addressing common inquiries about selling a property with liens is crucial to offering clarity and support to property owners. Providing insights into frequently asked questions can alleviate uncertainties related to liens, thereby offering valuable information to individuals navigating this intricate process. By responding to common queries, property sellers can obtain the necessary guidance to navigate the complexities of liens and make informed decisions throughout the sale process.

What is a lien sale on a house?

Understanding the process of a lien sale is crucial for property owners facing liens. It provides valuable knowledge about property-related transactions and helps comprehend the implications. Shedding light on the concept of a lien sale offers clarity and insights into dealing with liens.

Can you sell land with a lien on it?

Exploring the possibility of selling land with a lien provides valuable insights for property owners looking to sell. Understanding the implications and feasibility of selling land with a lien is crucial. Addressing this question offers essential knowledge for property sellers.

Related Post: Can You Sell a House With a Lien on it in California?

What is the most important first step for selling a house with a lien?

Understanding the lien on the property is crucial. Assess the lien amount and nature of the claim. Seek legal advice to clarify the legal implications. Determine how the lien affects the sale process. Research various types of liens that may impact the property sale.

Click Cash Home Buyers

Explore the benefits of choosing Click Cash Home Buyers for a quick and hassle-free selling process, even with outstanding liens. Their expertise in handling properties with liens ensures a smooth transaction. Consider the advantages of a cash offer from Click Cash Home Buyers, providing enough money to clear the remaining debt and release the lien. Understand the process of selling a house with a lien to Click Cash Home Buyers, ensuring a timely release of lien and valuable asset transfer. Request Your Quick and Easy Offer Today.

Request Your Quick and Easy Offer Today

Take the initial step in selling your property with a lien by requesting a no-obligation offer from Click Cash Home Buyers. Discover the convenience of obtaining a quick offer to sell the property and understand the process involved. By doing so, you can assess the potential benefits of receiving a swift and easy offer, which may help you navigate through any outstanding liens and related concerns effectively.

The Bottom Line

Selling a house with a lien in Fresno can be a complex process, but it is not impossible. By following the right steps and seeking professional guidance, you can successfully navigate this situation. It’s important to determine if there’s a lien on your property and understand the type of lien you’re facing. Validating the lien and exploring options such as paying it off or disputing it can help clear the title and make your property marketable. Working with a Southern California real estate investor can provide valuable insights and assistance throughout the process. If you have any questions or would like to explore your options further, feel free to comment below or contact us at (209)-691-0102 for a quick and easy offer.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.