Foreclosure is a scary word for lots of people who own homes. It means losing your house, dealing with money problems, and not knowing what’s going to happen next in the United States. But if you understand the risk of mortgage foreclosure and how the foreclosure process works, it can make things less scary and help homeowners figure out how to deal with this tough spot. The Consumer Financial Protection Bureau offers resources to help homeowners flag foreclosure scams and avoid falling victim to mortgage scams in the United States.

In our guide here, we’re going to take you step by step through all the parts of the mortgage foreclosure process. We’ll break down what happens legally and give you tips on how to stay away from mortgage foreclosure. Whether you’re in the middle of this right now or just want to be ready just in case, our mortgage foreclosure guide will give you all the details, including important information from the U.S. Department of Housing and Urban Development (HUD), so that making smart choices about keeping your home becomes easier.

Key Highlights

- When a homeowner falls behind on their mortgage, the lender can start the foreclosure process to take back control of the property.

- With foreclosures, it’s crucial for homeowners to know what rights they have and how being foreclosed on could affect them down the line.

- If you’re having trouble paying your mortgage, many lenders are open to helping out. They might adjust your loan terms so your monthly payments become easier to handle.

- Since foreclosure rules change from one place to another, knowing exactly how things work where you live is key.

Understanding Mortgage Foreclosure

Foreclosure is when the lender takes back control of a property because the person who borrowed money to buy it, known as the borrower, hasn’t been able to keep up with their mortgage payments. If you don’t pay your mortgage on time, you’re in what’s called default, and the lender may initiate foreclosure proceedings to recover the amount owed on the defaulted loan. This situation gives the lender the right to start foreclosure proceedings and eventually take over ownership of your home. Going through foreclosure can be really tough and complicated for homeowners, as it can result in the loss of their collateral – the property used to secure the loan. However, getting a good grasp on how this process works can make things a bit easier for borrowers facing such challenges, especially when it comes to understanding the consequences of defaulting on the mortgage contract. Understanding the different types of foreclosure purchases, such as purchasing bank-owned properties (REOs), can also be beneficial for buyers looking to invest in foreclosed properties.

What is Mortgage Foreclosure?

When a borrower doesn’t keep up with their mortgage payments, the lender can take back control of the property through something called foreclosure. Basically, when you get a mortgage, it’s like making a promise to pay back the money you borrowed to buy your house or property. If you stop making those payments on time, it means you’re not sticking to your end of the deal. This situation allows the lender to start what’s known as foreclosure action so they can get back what they’re owed.

There are two main ways this can happen: judicial and non-judicial foreclosure. With judicial foreclosure, things have to go through court because the lender needs an official order allowing them to foreclose on your home. On other hand in non-judicial foreclosures don’t need courts involved at all; instead there is already set process by state laws that lenders follow for taking over properties without needing any judge’s permission. However, in certain situations such as foreclosures involving home equity loans, reverse mortgages, or property owners’ association assessments, judicial foreclosure is required in states like Texas. This is also known as an “expedited foreclosure” and allows certain lienholders to foreclose on a property without going through the full court process, making it a crucial concept for those with home equity loans in Texas.

How the Foreclosure Process Begins

When someone doesn’t keep up with their mortgage payments, the foreclosure process usually kicks off. This happens after missing a few payments and incurring late fees. The lender then sends out a notice of default to the borrower, indicating that they are not in good standing with their loan agreement and are at risk of losing their home through foreclosure if things don’t get sorted out soon. Along with this heads-up, there’s advice on how to fix the situation and dodge foreclosure altogether, including utilizing a grace period offered by the lender. However, if the borrower can’t make things right within a given period, the lender might move forward with sending a demand letter and taking back ownership of the property through foreclosure, potentially resulting in additional late fees.

Causes and Consequences of Mortgage Foreclosure

Understanding the causes and consequences of mortgage foreclosure is crucial in navigating the complex realm of real estate. Factors such as missed mortgage payments, financial hardships, and changing economic conditions can trigger the foreclosure process. The consequences are far-reaching, leading to the loss of one’s home, damage to credit scores, and potential eviction. It is essential for homeowners to be proactive in seeking assistance and exploring alternatives to foreclosure to mitigate these devastating impacts.

Foreclosure Process

The foreclosure process begins with a missed mortgage payment, triggering a notice of default from the lender. If subsequent payments are not made, the lender may issue a notice of sale, which may be published in a local newspaper and posted on the property. This notice will inform the homeowner of the impending auction, including the date and time. Depending on the state laws and the type of foreclosure, including judicial, nonjudicial, strict foreclosure, and types of foreclosure, the process can vary. In judicial foreclosure states, court intervention is required, while in nonjudicial foreclosure states, the lender can proceed without court involvement.

What are the alternatives of Foreclosure

Facing mortgage foreclosure, homeowners can explore alternatives to mitigate the situation. Seeking options like loan modifications, refinancing, FHA programs, short sales, deeds in lieu of foreclosure, or selling to cash home buyers can provide relief. These avenues present opportunities to avoid the detrimental impact of foreclosure proceedings, offering potential solutions to financial distress. By considering various alternatives, individuals can potentially navigate through challenging circumstances and safeguard their interests amidst the complexities of real estate transactions. Investing time to explore such avenues, such as FHA programs and avoiding discrimination based on the use of public assistance, can potentially avert the harsh consequences of foreclosure.

The Impact of Foreclosure on Homeowners

Foreclosure has a profound impact on homeowners, extending beyond just losing their property. It can severely damage their credit score, making it difficult to secure future loans and impacting their credit report. Additionally, the emotional toll of losing one’s home can be overwhelming. Families may face the stress of finding new accommodation, disrupting their daily lives. Foreclosure can also lead to potential financial hardship, affecting the homeowner’s ability to rent or buy another home. Ultimately, the impact of foreclosure on homeowners goes far beyond the loss of property, impacting their financial stability and emotional well-being significantly. Understanding how foreclosure is added to a credit report and the potential consequences can help homeowners make informed decisions about their financial future.

The Legal Proceedings of Foreclosure

When a lender needs to take back a property because the borrower hasn’t kept up with payments, this is known as the foreclosure process. It can go two ways: through judicial foreclosure or non-judicial foreclosure. With judicial foreclosure, the lender has to go to court and get permission by proving their case against the borrower who gets a chance to fight back with any defenses they have. If the judge agrees with the lender, then they’ll allow for an auction of that home so money can be raised to pay off what’s owed. On another note, in non-judicial foreclosures, there’s no need for court time because state laws give lenders a clear path on how to claim back their property without involving judges or lawsuits. However, in both cases, the local sheriff plays a crucial role in the foreclosure process, either by conducting the auction or overseeing the transfer of ownership to the lender. Understanding the legal proceedings of foreclosure, including the involvement of the local sheriff, is essential for homeowners facing this difficult situation.

Navigating Through Pre-Foreclosure

Pre-foreclosure happens before a property is fully taken over due to missed payments. During this phase, the person who borrowed money for the house usually gets a chance to catch up on their mortgage and stop the foreclosure process. It’s often a tough and stressful period, especially when someone is going through financial troubles. For those in pre-foreclosure, it’s crucial to act quickly and look into ways they can fix their situation with overdue payments. This might mean talking things out with their lender to change loan terms, considering selling the property for less than what’s owed (known as a short sale), or checking out other ways to prevent losing their home.

The Auction Phase

At the end of the foreclosure process, there’s an auction where they sell the house to whoever offers the most money. This event is open for anyone to attend and it usually happens at a courthouse or another place that’s picked out ahead of time. The person who bids the highest gets to be the new owner of that house. During this part, which we call the auction phase, things can get pretty tough and emotional for homeowners because it means they’re losing their home. But even so, it’s key to remember there are ways you might still be able to keep your home or defend your rights during this foreclosure stage known as bidding by potential owners including those aiming to become highest bidder. Additionally, it is important to note that once the auction ends and a new owner is named, the borrowers are issued an order to evacuate if they are still living in the property. This eviction notice demands that any persons living in the house vacate the premises immediately, as it is now under new ownership and any liens or unpaid taxes on the property will need to be addressed by the new owner’s personal belongings.

Alternatives to Foreclosure

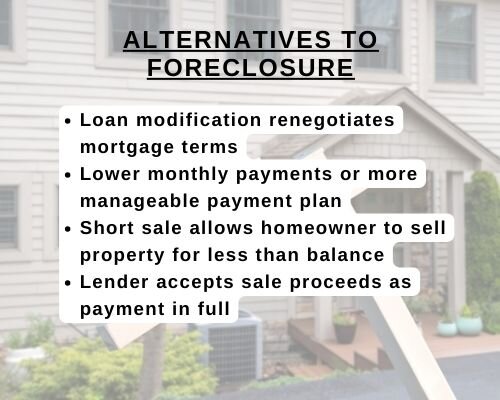

Foreclosure is a significant financial event that can have long-term consequences for homeowners. However, homeowners facing financial difficulties have alternatives to foreclosure that can help them avoid the foreclosure process.

One alternative is a loan modification, which involves renegotiating the terms of the mortgage with the lender. This can result in lower monthly payments or a more manageable payment plan.

Another option is a short sale, where the homeowner sells the property for less than the remaining mortgage balance. In a short sale, the lender agrees to accept the proceeds of the sale as payment in full, allowing the homeowner to avoid foreclosure.

Loan Modification and Refinancing Options

A loan modification is one of the alternatives to foreclosure that homeowners can explore when facing financial difficulties. This option involves renegotiating the terms of the mortgage with the lender to make the monthly payments more affordable.

During a loan modification, the lender may adjust the interest rate, extend the loan term, or forgive a portion of the principal balance. These changes can help homeowners lower their monthly mortgage payments and make them more manageable.

Refinancing is another option that homeowners can consider. Refinancing involves replacing the current mortgage with a new loan, often with more favorable terms. This can result in lower interest rates and monthly payments.

Both loan modification and refinancing options require homeowners to work with their lenders and provide financial documentation to demonstrate their financial hardship and the need for assistance. It is important for homeowners to reach out to their servicer, the company that manages their mortgage, as soon as they anticipate difficulty in making their mortgage payments to explore these options.

Short Sales and Deeds in Lieu of Foreclosure

In certain situations, homeowners facing financial distress may consider a short sale or a deed in lieu of foreclosure as alternatives to the foreclosure process.

A short sale involves selling the property for less than the remaining mortgage balance. The lender agrees to accept the proceeds of the sale as payment in full, allowing the homeowner to avoid foreclosure. Short sales can be a viable option for homeowners who are unable to catch up on their mortgage payments and owe more on their mortgage than the current value of the property.

A deed in lieu of foreclosure occurs when the homeowner voluntarily transfers ownership of the property to the lender instead of going through the foreclosure process. This option can be beneficial for both parties, as it allows the homeowner to avoid foreclosure and the lender to avoid the time and expense of the foreclosure process.

Both short sales and deeds in lieu of foreclosure require the cooperation of the mortgage lender, and homeowners should consult with their lender to determine if these options are available to them.

Selling To Cash Home Buyers

Selling to cash home buyers can be a swift solution for homeowners facing mortgage foreclosure. These buyers are typically investors or companies ready to purchase properties quickly, offering a cash payment that can help homeowners avoid the lengthy process of foreclosure. By selling to cash buyers, homeowners can often sell their homes as-is, without the need for repairs or prolonged listing periods. This option can provide a faster way to offload the property and settle the outstanding mortgage debt before foreclosure proceedings advance further.

Are there any alternatives to foreclosure for homeowners facing financial difficulties?

Yes, homeowners facing financial difficulties may consider alternatives like loan modification, short sale, deed in lieu of foreclosure, or refinancing. These options can help avoid the negative impact of foreclosure on credit scores and provide a more manageable solution to financial challenges.

Final Thoughts

For homeowners who are having a tough time with money, it’s really important to get how the whole foreclosure process works. From when it starts all the way to what happens after, every part needs you to think carefully and know what you’re doing. If you’re looking at different choices or getting ready for a foreclosure auction, understanding everything well helps you make smart choices. Getting help from counseling services can offer some good advice and support when things feel too hard. It’s key to remember that there are ways out of facing foreclosure and lessening its bad effects on your credit score and chances of owning a home in the future. If there’s anything on your mind or if you want to talk about this more, just drop a comment below.

Frequently Asked Questions

Can I Save My Home from Foreclosure If I Act Quickly?

If you’re facing financial hardship or think you might struggle to make your mortgage payments, it’s crucial to get in touch with your lender right away. By acting fast, you boost your odds of keeping your home out of foreclosure. Lenders usually prefer to help borrowers figure out a way through tough times by offering options like loan modifications or payment plans that can prevent the need for foreclosure.

How Long Does the Entire Foreclosure Process Take?

How long the foreclosure process takes can really depend on a bunch of things, like whether it’s a judicial or non-judicial type and what the laws are in your state. On average, this whole thing could last from several months to even more than a year. To get the real scoop on how long it might take where you live, talking to someone who knows all about legal stuff is pretty important.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.