Key Highlights

- Cash offers stand out in competitive real estate markets due to faster closing times and reduced risks for sellers.

- While timelines vary, cash purchases can close significantly faster than traditional financing, potentially within a week or two, without going through the mortgage process.

- Sellers favor cash offers as they eliminate financing contingencies and often lead to quicker closings.

- Despite the streamlined nature of cash deals, engaging a real estate agent remains crucial.

- Cash buyers often benefit from lower closing costs and increased negotiating power.

- Potential delays in cash transactions can arise from title issues, liens, or unforeseen property concerns that could affect a cash-out refinance.

In the fast-changing world of real estate, buying and selling homes can feel like a rush, particularly when interest rates are fluctuating. With the tough processes of getting mortgage loans and the changing housing market, cash offers have become a valuable choice for buyers and sellers who want quick deals and extra money. A cash offer means collaborating with a specialized type of buyer to buy a house directly without using mortgages or loans, and often the buyer can prove they have the necessary funds in a bank account. This simple method has its own benefits, especially quicker closing times, which are very attractive in today’s busy real estate scene and for home sales without using a mortgage.

Understanding What is Cash Offers

Cash offers happen when a buyer uses cash to buy a property. A cash home purchase means they do this without getting a mortgage. Cash buyers, representing a significant share of all cash buyers, do not need to go through the financing stage, which can make the closing process faster and easier, especially when they pay cash. This way is liked because it is simple and quick, especially compared to going through the mortgage process. Sellers often prefer cash offers when they want to sell their house for cash quickly, especially in light of rising home prices. These offers usually come from real estate investors or people who have enough cash to buy a home without needing a loan, often leading to a house poor situation if not managed wisely. Cash offers can provide benefits in competitive real estate markets.

Why Sellers Prefer Cash Buyers

From a seller’s view, choosing a cash buyer offers many strong benefits. First, cash sales are part of a business model that ensures they are fast, often because buyers are offering all cash. There are no delays from loans or other processes. This means a quicker closing time, which is good for sellers who need to move quickly, like for a new job, or simply to sell their property faster without worrying about mortgage payments.

Also, a cash offer gives sellers a sense of security, as obtaining proof of funds can help to solidify the buyer’s financial capability. Financed offers depend on the buyer getting a loan, which can be risky. Cash offers remove that worry. This can give sellers peace of mind, knowing their deal is less likely to fall apart due to financing issues. Sometimes, sellers might accept a lower offer from a cash buyer just to avoid the risks and delays of traditional financing.

Another strong reason sellers prefer cash buyers is that there is less paperwork and fewer hassles, allowing them to finalize the cash for a property more efficiently. Since there is no bank involved, the closing process is much easier. With fewer people in the deal, there is less paperwork and fewer problems, making it easier to close on a house in cash. Overall, this makes things smoother for both buyers and sellers.

Speed of Transactions with Cash Offers

The appeal of speed in real estate is clear. Cash offers are the best option for quick transactions. When we compare them to traditional sales, cash deals are faster. The time it takes to close can depend on factors like where the property is, any title issues, or problems that pop up, but cash sales are usually much quicker than financed ones.

One big reason for this speed is that cash sales do not need loan processing. This part of traditional real estate deals can take a lot of time and can be unpredictable. Cash buyers can move quickly without needing to worry about getting a loan or going through the mortgage process. They often finish the closing process much faster, often in a few weeks or even days, depending on the situation and how well everyone works together.

This quick timeline is great for buyers since it lets them have their new property sooner, especially if they can pay in cash. It also gives sellers the relief and comfort of a fast sale when you’re paying cash. Many sellers like to complete their sale quickly, as it leads to a smoother experience and a chance to make a cash offer.

The Timeline for Paying Cash for A House

The cash sale process happens quickly from start to finish, allowing buyers to make a cash offer with confidence. Usually, the first offer is accepted in just 1 day. After that, it takes 24 to 48 hours to verify the buyer’s funds, especially if they plan to pay in cash. Securing title and escrow is done in 1 day. The earnest money needs to be submitted within 1 day, while the title search takes about 3 days. Inspections can be set up within a week and usually last between 2 to 4 hours, ensuring that buyers are well-informed before making a cash payment. This makes the whole process smooth.

1. Initial All-Cash Offer to Acceptance: The Quick Turnaround: 1 day

The process to accept an offer from a cash homebuyer in a cash sale for a new home can be very fast, allowing you to buy the house you want without delays. It can often be done in just 1 day. Cash buyers usually make their offers quickly to finish the deal smoothly, and they may negotiate a lower price. This fast acceptance process is different from regular sales. In those, getting approvals for loans can take much longer. For sellers, cash offers are helpful. They can sell their new homes quickly and without any problems, often opting for a cash payment to expedite the process.

2. Verifying Buyer’s Funds: Ensuring a Smooth Home Sale: 24 to 48 hours

Before starting a cash sale, it is important to check if the buyer has enough money. This should be done within 24 to 48 hours. By making sure there are funds available, you can prevent problems, which helps the sale go smoothly. This step is key for both sides and ensures a successful sale. Quick verification also builds trust and confidence, which is essential for a good real estate deal. A fast process speeds up the whole timeline and makes the sale happen with fewer interruptions, especially for those who choose cash instead.

3. Securing of Title and Escrow in Cash Transactions: 1 day

Once the cash offer is made, getting the title and escrow is usually done quickly, often in one day. This speedy process happens because cash buys simplify things a lot. Getting the property transferred legally and setting up escrow efficiently helps make cash transactions in real estate smooth. In this short time, all the needed papers and legal details are handled quickly to cover the closing costs. This is an important step towards successfully finishing the sale, particularly when a buyer is looking to purchase a home quickly and may need to pay the purchase price in cash.

4. Submission of Earnest Money: 1 day

Once the first offer is accepted, the buyer usually submits earnest money within one day in a cash deal, demonstrating their ability to pay for a house quickly. This shows that the buyer is serious about going ahead with the purchase and is important for making the deal official. By quickly giving the earnest money, buyers show their commitment and follow the steps needed for the sale. This fast timing highlights how effective and dependable cash purchases are in real estate deals.

5. Title search: 3 days

During the title search, which usually lasts about 3 days, we look closely at public records. This check helps to make sure the property’s ownership history is clear. This step is important for confirming that the title is valid. It also helps find any liens or disputes that might impact the sale.

6. Inspections: One week to book; 2 to 4 hours to complete

Inspections usually take about a week to set up. They can take from 2 to 4 hours to finish. This step is important to find any problems with the property before making an all-cash offer, avoiding issues like mortgage origination fees. It also helps both the buyer and seller be honest about the sale. During the inspection, the inspector will check the house carefully to ensure there are no hidden issues that could affect the value of the house with cash may be used to purchase. They will look at things like the structure, systems, and general condition. It is a good idea to go with the inspector. This way, you can learn about the property and deal with any worries right away, especially if you’re considering buying a house in cash.

7. Appraisal: 15 minutes to 5 days

Appraisals in real estate can take a short time or a long time. They can be done in just 15 minutes or take up to 5 days. This time depends on a few things, like how complex the property is, where it is located, and how many appraisers are available. A simple property might be appraised quickly. But a more complex one may need more time for a good review. Quick appraisals are liked by both buyers and sellers, as they help expedite the home buying process, especially when going through the mortgage process. They help speed up the closing process and make the property transaction finish faster and smoother, particularly for buyers who don’t have a mortgage.

8. Final walkthrough: 1 day

Before you buy a house with cash, an important step is the final walkthrough. This usually happens in just one day. During this time, buyers check the property one last time to ensure they have enough cash to purchase it. They want to ensure that everything is set before closing. Buyers can see if any repairs they asked for have been done. They can also check that all agreed-upon fixtures are still there. This is the last chance to make sure the house meets their expectations before making the purchase official.

9. Closing: 1.5 to 2 hours

The closing process for a house that is bought with cash usually takes about 1.5 to 2 hours. At this time, all the important paperwork is looked over, signed, and notarized before the buyer can officially purchase a home. This is how ownership is transferred from the seller to the buyer, affecting the final price of the transaction. This quick timeframe is a big benefit of cash purchases, allowing buyers to pay all cash. It skips the long wait for mortgage approvals and other delays. Cash buyers can quickly finish the purchase and start on their new property investment.

Cash Buyers Key Milestones in the Process of Buying A Home

Understanding the important steps in a cash buying timeline is helpful for both buyers and sellers. Knowing what to expect at each stage can make the process go more smoothly. It can also lead to a quicker closing when paying cash for a house. From the first offer to the final closing, each step is key to completing the real estate deal, especially when making a cash offer, as it can save money in the long run.

Having a clear timeline builds trust and cuts down on misunderstandings and holdups. When both buyers and sellers set clear goals from the beginning, they can work together confidently. They know they are moving toward the same objective.

Conducting a Title Search: What You Need to Know

In the world of real estate deals, a title search is a key step. It helps protect the interests of both buyers and sellers. This careful check of public records looks for any problems that might affect the title of a property. It makes sure the transfer of ownership is smooth and legally safe.

You can think of a title search as looking at a property’s ownership history. A title company usually does this search. They go through public records and review documents like deeds, mortgages, liens, and judgments. They track the chain of ownership from the current owner back to the first one, similar to buying a house with a mortgage. This thorough check helps protect buyers from gaining hidden disputes or claims that could come up later and threaten their ownership rights.

The title search also finds any current liens, such as unpaid property taxes or contractor’s claims. By identifying these issues early, they can be resolved before the closing. This ensures that the new owner gets a clear title. Additionally, the search can reveal easements, restrictions, or rules tied to the property. This gives buyers a full understanding of any limits or duties that might affect how they use the land.

Importance of Home Inspections for Cash Deals

In the fast-moving world of cash real estate deals, it may be tempting to rush the closing, especially when offering all cash. However, it is important not to ignore the value of a home inspection, especially when you are paying cash for a property. For buyers wanting to make smart choices in a market full of unknowns, getting a proper home inspection is crucial to avoid missing out on mortgage opportunities and to ensure they can pay the purchase price confidently. It shouldn’t be viewed as just a step to skip for speed.

While experienced real estate investors might waive inspections to close faster, average homebuyers, especially those who are new to real estate, really need this step to avoid cons of paying cash. A home inspection acts as a shield, helping buyers avoid expensive issues that could be hidden in what looks like a perfect home, especially when they are paying cash.

A licensed inspector carries out the inspection. This means carefully checking major parts of the home, like the roof, foundation, plumbing, electrical systems, and HVAC. The goal is to find any hidden problems, safety risks, or structural concerns that might not show up during a casual look at the house.

Appraisal and Its Impact on Cash Sales

While cash sales are fast and simple, people often discuss the need for an appraisal. Appraisals are important in mortgage-based purchases. They help make sure lenders do not pay too much for a property. However, cash deals seem to need appraisals less at first.

Still, appraisals are useful in cash transactions, ensuring that buyers are making a cash offer that reflects the true value of the property, which helps them avoid missing out on mortgage interest. They give both buyers and sellers important information about the implications of paying all cash versus financing through a monthly mortgage, emphasizing the benefits of buying a house in cash. For buyers, an appraisal shows the property’s true market value, which is crucial when deciding how much money to buy the home. This is important to avoid paying too much, especially when the real estate market is changing quickly.

An appraisal can help buyers if they want to use the property for future loans. It can also give them confidence that they are making a good investment, particularly when paying cash for a home.

For sellers, an appraisal can support the asking price and help them understand what cash means in this context. This is helpful, especially when there are multiple offers. If the appraisal matches or is more than the asking price, it can help the seller in negotiations.

Closing Day: What to Expect

Closing day is an important moment in a real estate deal. It wraps up weeks of talks, paperwork, and waiting. This day is when the new homeowners receive their keys. This process may feel hard, especially for first-time buyers or sellers. However, knowing what happens on closing day can help make it easier.

The closing usually takes place at a title company office or with a real estate lawyer, especially when you’re buying a house for cash. Everyone involved comes together, including buyers, sellers, their real estate professional agents, and a closing agent. They meet to finalize the sale and transfer the property. Before this day, buyers often do their homework, especially regarding the amount of cash they are willing to invest. This includes a home inspection, possibly an appraisal, and a title search to resolve any issues early on.

On closing day, the main task is to read and sign many legal papers, which may include documents indicating that you plan to pay for the home in full. These papers finalize the ownership change and expected payments, which may include cash payments for homes sold without a mortgage. Buyers may need to sign a mortgage note (if they have one), a deed of trust, and related loan documents as part of one of the biggest financial decisions they will ever make, especially if they apply for a mortgage. Sellers will sign papers to give up their rights to the home.

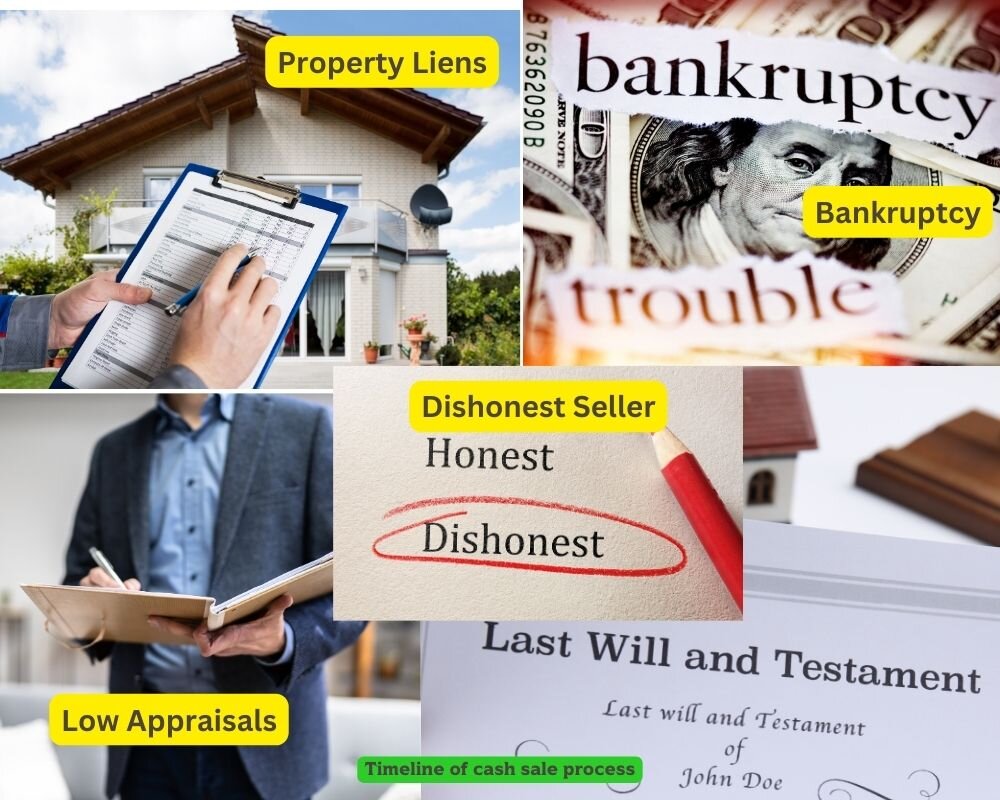

Common Hurdles in Cash for a Home Transactions

Cash transactions in real estate are often praised for being fast and efficient, particularly when a large cash offer is made. However, it’s important to recognize that even these simple deals can face challenges. Knowing about these possible issues helps both buyers and sellers handle them better. This can reduce delays and make the closing process smoother.

From unexpected title problems to last-minute talks, understanding common hurdles helps everyone think realistically. They can expect challenges and work together to fix them.

Dealing with Property Liens and Encumbrances

In real estate, there are high risks, many laws to understand, and the pros and cons of buying a home with cash to consider, especially if opting for a rocket mortgage instead of going through the mortgage process. Liens or encumbrances on a property can create problems during a sale. These claims often relate to money owed or legal issues. They can slow down the process or stop a sale entirely.

Liens and encumbrances can come from different places, and each one has its own effects. For example, mortgages are a common type of voluntary lien. In this case, owners use their home with a mortgage as security for a loan. Other examples include making a cash offer on properties that are highly sought after, which can sometimes be better than the cons of a cash offer.

- Mechanic’s Liens: Workers who have done jobs on the property and have not been paid can file a mechanic’s lien.

- Judgment Liens: If a judge rules against a property owner, that owner might face a judgment lien on their property to make sure they pay.

- Tax Liens: If property taxes are not paid, a tax lien can be placed. This lien has priority over others, which can complicate the process for buyers who want to pay cash.

Bankruptcy

Facing bankruptcy can make selling a house harder. This is especially true if there are liens or legal problems. In these cases, it is important to get help from legal and financial advisors. They can help you with the cash sale process, which can be advantageous compared to the cons of a cash offer. Bankruptcy might slow down your house sale. This is because you may need extra approvals and court help. Both buyers and sellers should understand how bankruptcy can affect real estate transactions. This ensures everything goes smoothly and follows the law.

Resolving Issues When a Seller is Dishonest

In a perfect world, real estate deals would be clear and fair for everyone. This would make sure that all parties feel safe and secure, knowing the buyer is prepared to pay cash. Sadly, this is not always the case, as some sellers are dishonest. Their actions can lead to serious problems for unaware buyers.

Dishonesty can come in many ways, such as hiding problems with the property or lying about its finances, which is crucial to consider when deciding to pay for the home in full. Here are some common examples of how to pay for a home in cash.

- Hiding Property Defects: A dishonest seller may try to hide signs of water damage, mold, foundation issues, or other faults that could reduce the property’s value.

- Misrepresenting Square Footage: Some sellers may stretch the truth about the size of a home to make it seem more valuable.

- Failing to Disclose Material Facts: Sellers must legally reveal any important facts they know that could influence a buyer’s choice to buy the property.

Deceased Person Being on Title

Real estate transactions can be exciting, but they can be tricky if a deceased person is named on the title of a property, complicating the process of buying a home. This situation is not rare, so it’s important to handle it carefully. You need to know about the probate process and the legal steps required to transfer ownership from a deceased owner to a rightful heir or beneficiary before selling.

When a property owner dies, their belongings, including real estate, usually go through a legal process called probate. Probate is a court-managed procedure that confirms the deceased person’s will if there is one. It also decides how their assets will be shared with heirs or beneficiaries. A court appoints an executor or administrator to oversee everything related to the estate’s assets, including any home with cash means. They make sure all debts and taxes are paid before sharing the remaining assets according to the will or laws if there is no will, which is essential when someone wants to buy the house.

If a deceased person is on the title of a property and the property is going through probate, it can be legally problematic to sell the property before probate is finished.

Option periods

In the busy world of real estate, option periods are a helpful tool for buyers. They offer a short time to check everything and make a choice without rushing to close the deal. This is part of a real estate contract. It gives buyers the right, but not the duty, to buy the property at a set price within a specific time.

During the option period, buyers can usually:

- Conduct Inspections: Hire experts to look closely at the property for any problems like structural issues, pests, or other worries.

- Secure Financing: If not paying with cash, buyers can use this time to complete their mortgage application and get the needed money.

- Review Title Work: Order a title search to confirm clear ownership and find any issues related to the property before paying cash for a house.

Low appraisals

In real estate transactions, the appraisal process is very important for finding a property’s fair market value, especially if you’re buying a house with cash. Even though cash buyers do not need appraisals for loans, a low appraisal can still cause problems and affect the deal.

A low appraisal happens when a licensed appraiser looks at things like recent sales, the property’s condition, and market trends, especially when you’re paying cash. If the appraiser decides that the property’s value is lower than the purchase price, it creates issues for both buyers and sellers. This often leads to changes in negotiations or, in some cases, ending the contract for a cash offer on a house.

For cash buyers, a low appraisal can make them worried about paying too much for the property. Although cash offers usually seem strong, a low appraisal may show that the price they agreed on does not really match the property’s true market value.

What are the advantages of buying a house with cash?

Buying a house with cash offers advantages like quicker transactions, lower overall costs due to no interest on loans, and increased bargaining power with sellers. Cash buyers often have an edge in competitive markets and can avoid appraisals or lender requirements, streamlining the buying process.

Advantages of Selling Your Home for Cash

Bypassing Traditional Financing Hurdles

In the real estate world, getting through the mortgage process can feel difficult compared to making a cash payment offer on a home. There is often a lot of paperwork, approvals, and issues to deal with in the home buying process. For sellers who want to sell their property quickly and avoid problems with financing, cash buyers are a great option. They can skip the issues that usually slow down traditional sales.

One big benefit of cash sales is that they avoid the long mortgage approval process, which can be particularly advantageous for those purchasing a second home. In a regular sale, it is important for the buyer to get financing, especially if they are planning to take advantage of the mortgage interest deduction, which can be a disadvantage of buying a house with cash instead. The sale depends on their loan being approved by the bank, and in some cases, home equity can be leveraged for better financing options, highlighting the disadvantages of buying a house without cash. This can make things uncertain, especially for those who might be relying on rental income. Problems with the buyer’s credit, income checks, or property value could pop up, causing delays.

Minimizing Seller Fees and Closing Costs

Sellers in real estate want to make more money while spending less, often by encouraging buyers to consider paying cash for a house. Selling a home comes with many costs, such as agent fees and closing costs, which can be minimized by making a cash offer. Cash sales have become popular because they can lower expenses and make selling easier.

One big benefit of cash sales is the chance to lower or even get rid of some fees. Usually, sellers face costs like:

- Real Estate Commissions can be a significant factor when considering whether to make a cash offer on a home or apply for a mortgage. Paying both the listing agent and the buyer’s agent can cost a lot, usually between 5% to 6% of the sale price, especially if you’re not buying a house in cash.

- Closing Costs: Sellers often pay several costs, including title insurance, escrow fees, and transfer taxes.

Hassle Free Selling and Fast Closing: Click Cash Home Buyers

In today’s fast-paced real estate market, we at Click Cash Home Buyers understand that selling your house can feel like a daunting task. The traditional process often involves lengthy listings, numerous showings, and uncertain timelines. But what if there was a simpler way?

That’s where we come in. As click cash home buyers, we’ve revolutionized the home-selling process, making it quicker and more straightforward than ever before.

See how we can help you!

Here’s how we’re changing the game:

Speed: We can make an all-cash offer within 24 hours of seeing your property. No more waiting for months to find the right buyer.

Convenience: Our process is primarily online. This means no need for multiple in-person showings or disrupting your daily life.

Certainty: With us, you don’t have to worry about buyers’ financing falling through. We make all-cash offers, period.

Simplicity: We buy houses ‘as-is’. No need for repairs or renovations on your part.

We’ve embraced technology to streamline the entire process, from initial contact to final sale.

This approach eliminates many of the common hurdles homeowners face when selling, such as:

Long listing periods

Countless showings

Uncertain closing dates

Last-minute financing issues

At Click Cash Home Buyers, we’re not just in the business of buying houses; we’re here to provide a stress-free solution for homeowners looking to sell quickly and efficiently.

We understand that every situation is unique, and we’re committed to working with you to find the best solution for your needs. Whether you’re relocating for a job, dealing with financial challenges, or simply ready for a change, we’re here to help.

Interested in learning more about how we can make your home-selling experience smoother and faster? We’d love to chat. Reach out to us today for a no-obligation cash offer and discover the Click Cash Home Buyers difference.

Remember, selling your home doesn’t have to be complicated. Let’s simplify the process together!

The Bottom Line

In the fast-changing world of real estate, it’s key for both buyers and sellers to understand cash offers. Knowing the specifics can help them make better financial decisions and feel more sure about their deals when considering paying cash for a house.

Sellers greatly benefit from cash offers, especially when they don’t have a mortgage. They can close the sale faster and face less risk of financing issues. A simpler negotiation is often part of the deal too. This faster sale, along with less paperwork and lower closing costs, is really appealing, especially for those who need to sell quickly and avoid a mortgage lender.

Buyers can also benefit from cash offers. These offers help them stand out in crowded markets, particularly when making an all-cash offer that shows they have enough cash to purchase the property. When buyers can offer cash, they often have more chance to win over sellers. This ability to close quickly can lead to a smoother transaction and sometimes even a better purchase price.

Frequently Asked Questions

How Quickly Can a Cash Sale Close Compared to Traditional Financing?

A cash sale can finish much quicker than a traditional sale that needs financing. Traditional sales may take about 30 to 45 days or even more. In contrast, a cash sale can wrap up in just a week or two, allowing buyers to purchase a house in full quickly. This depends on the plans of the buyer and seller, and how prepared everyone is.

What Are the Risks of Selling to a Cash Buyer?

Selling to a cash buyer is usually safer than selling to someone who needs a loan. This is because you don’t have to worry about the loan not going through. Still, it’s key to do your due diligence when considering the pros and cons of paying cash. Make sure to check the buyer’s funds and be sure you are okay with all the terms of the sale before going ahead.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.